Introduction

Passive income is the dream of numerous individuals. Earning money while sleeping, freeing time for oneself, and giving financial security are its features. In this blog post, we will show different ways to create a stream of passive income and discuss certain benefits and considerations for each of these methods.

Investing in Real Estate

Real estate is one of the common passive income asset classes. You can buy properties to create your passive income from such an asset and then rent them out. Besides, real estate investments often appreciate in value over time, thereby providing the potential for long-term wealth building.

But investment in real estate requires due research and management. Other factors you have to consider are location, market conditions, and property management. Be prepared for unexpected expenses and develop a plan of action for issues that may arise regarding tenants.

Creating and Selling Online Courses

If you have knowledge or expertise in a particular field, creating and selling online courses can be a lucrative passive income. Remarkably, with platforms like Udemy and Teachable, it is easy to create and sell your courses.

The online course development emphasizes value provision and the delivery of quality content. Consider the target audience and the needs they have, structuring your course accordingly. Invest in the time to market and promote your course for better reach and returns.

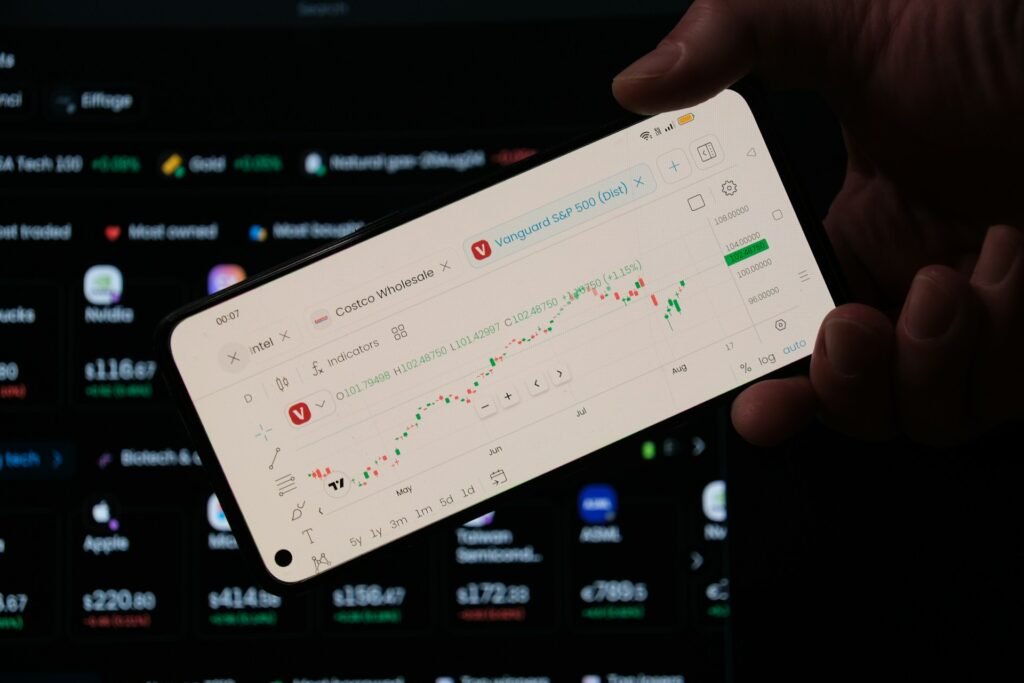

Building a Dividend Portfolio

Dividend stocks are another avenue to passive income. Here, you will be able to get a regular inflow of money by using your investments in companies that pay dividends.

Building a dividend portfolio involves the idea of diversification in decreasing risk. The next step is to research companies that have consistently paid dividends and have strong financials. Then, every so often, review and adjust your portfolio to make sure it aligns with your investment goals and risk tolerance.

Creating and Monetizing a Blog or Website

Writing or blogging can be a passive income activity if you like to write or have something important to say about something. Advertising, sponsored posts, and affiliate marketing are some of the best ways to monetize your blog by publishing valuable content and building a loyal audience.

First, choose a niche with which you are conversant and for which you have an enormous amount of passion. Secondly, on this same niche, work out quality content that resonates with your audience. Invest in blog promotion and building your brand online to lure in possible sponsors and advertisers.

Conclusion

It takes plenty of time and effort, along with much planning, to build up a source of passive income. Whether investing in real estate, creating online courses, building a dividend portfolio, or even starting a blog, in every process, one has to think strategically.

From a practical standpoint, consider what each path has in common with your strengths, interests, and long-term goals. Diversify streams of revenue as an investment to minimize risk and maximize prospective earnings. And finally, above all else, be patient and persistent: it takes time to build passive income, but the rewards can be quite worth the effort.